Get Approved with Confidence — Your Mortgage Starts Here

Schedule Your Free Mortgage Strategy Session

Let’s talk about your goals — no obligations, just expert guidance. Book now and we’ll follow up with answers to your most important questions.

Robert Paucar, MLO

At The Loan Pros Team Inc., we believe that mortgages should never be one-size-fits-all. Every homebuyer, investor, and borrower deserves a solution tailored to their goals. That’s why we offer a wide range of loan options—from FHA, VA, and USDA loans to niche programs like DSCR, rental income, foreign national, and Airbnb loans. Whether you’re buying your first home, refinancing for better rates, or investing in a fix-and-flip opportunity, our approach is built around making the process simple, stress-free, and aligned with your financial future.

The Advantages of Working with Us

Tailored Loans, Real Results: Every loan is customized to fit your goals, whether you’re self-employed, a first-time buyer, or a seasoned investor.

Customer-Centric Approach: Our team takes the time to understand your needs and guide you with clarity and care.

Fast, Hassle-Free Process: We simplify every step with a tech-driven, streamlined process that gets you funded without the stress.

Licensed in 40+ States: We offer consistent service and support no matter where you’re buying or refinancing.

Frequently Asked Questions

What documents do I need to apply for a mortgage?

You’ll typically need proof of income, bank statements, tax returns, and credit information. Specific requirements may vary by lender.

How much can I borrow for my mortgage?

Your borrowing amount depends on your income, credit score, down payment, and debt-to-income ratio. A pre-approval can give you a clearer estimate.

What’s the difference between a fixed-rate and adjustable-rate mortgage?

A fixed-rate mortgage has a steady interest rate throughout the term, while an adjustable-rate mortgage (ARM) has a rate that may fluctuate after an initial fixed period.

How long does the mortgage approval process take?

The timeline can vary but generally takes 30-45 days, depending on factors like document verification, appraisals, and lender-specific processes.

Testimonials

Working with Robert Paucar and his team was a pleasure. He takes care of everything with such ease, I was comfortable and completely trusted him and his process. Robert and his team were very knowledgeable, efficient, and friendly. I highly recommend Robert Paucar and his team! Thank you!!

— Karla P.

I cannot express my gratitude enough for the exceptional service I received from Robert. From the moment we started working together, he showed a deep understanding of our needs and a genuine dedication to helping us. Thank you, Robert, for your hard work and the sincere care you showed us throughout this journey!

— Maricar C.

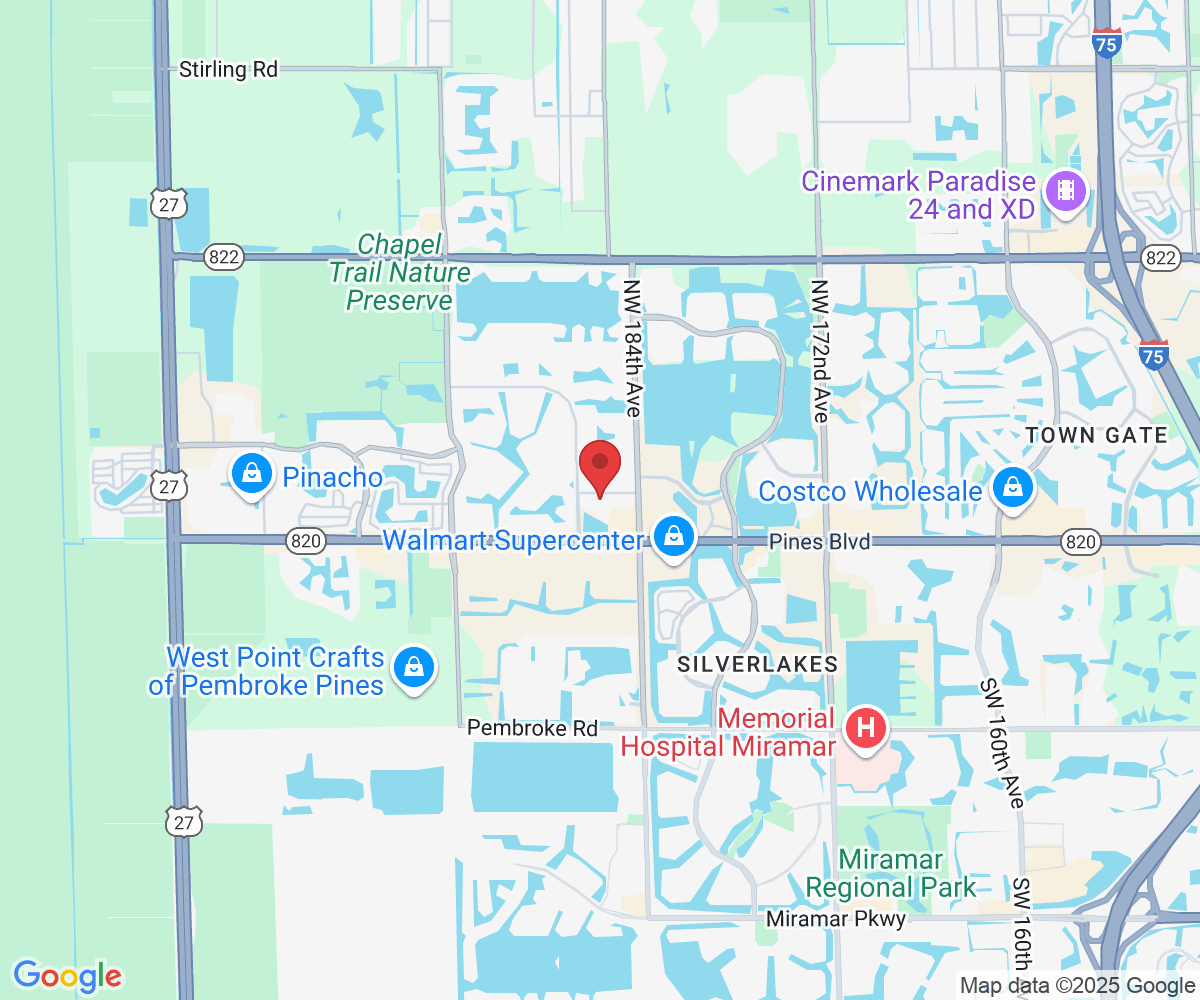

Location: 18503 Pines Blvd. Suite 310 Pembroke Pines, FL 33029

Call (754) 273-5573

Email: [email protected]

Site: www.RobertPaucarMLO.com